GENERAL PARTNER (GP)

Multi Fund (+4 Fund Incorporation) Structure

Our pricing model offers flexibility for incorporating more than four funds, including adaptable plans for Luxembourg-based investments, ensuring effective management of diverse trading strategies.

Custom GP Branding and Efficiency

Our solution helps General Partners with tailored branding and streamlined operations, enabling efficient fund management and a strong market position.

Our General Partner Solution?

Managing multiple funds requires careful coordination, efficient systems, and expert support. Our General Partner (GP) incorporation solutions are tailored for clients intending to set up more than four funds, with each one customized to align with their brand identity. These services are designed to streamline operations, ensure full regulatory compliance, and support scalable growth, helping clients optimize fund management while maintaining a cohesive brand.

Our General Partner Solution

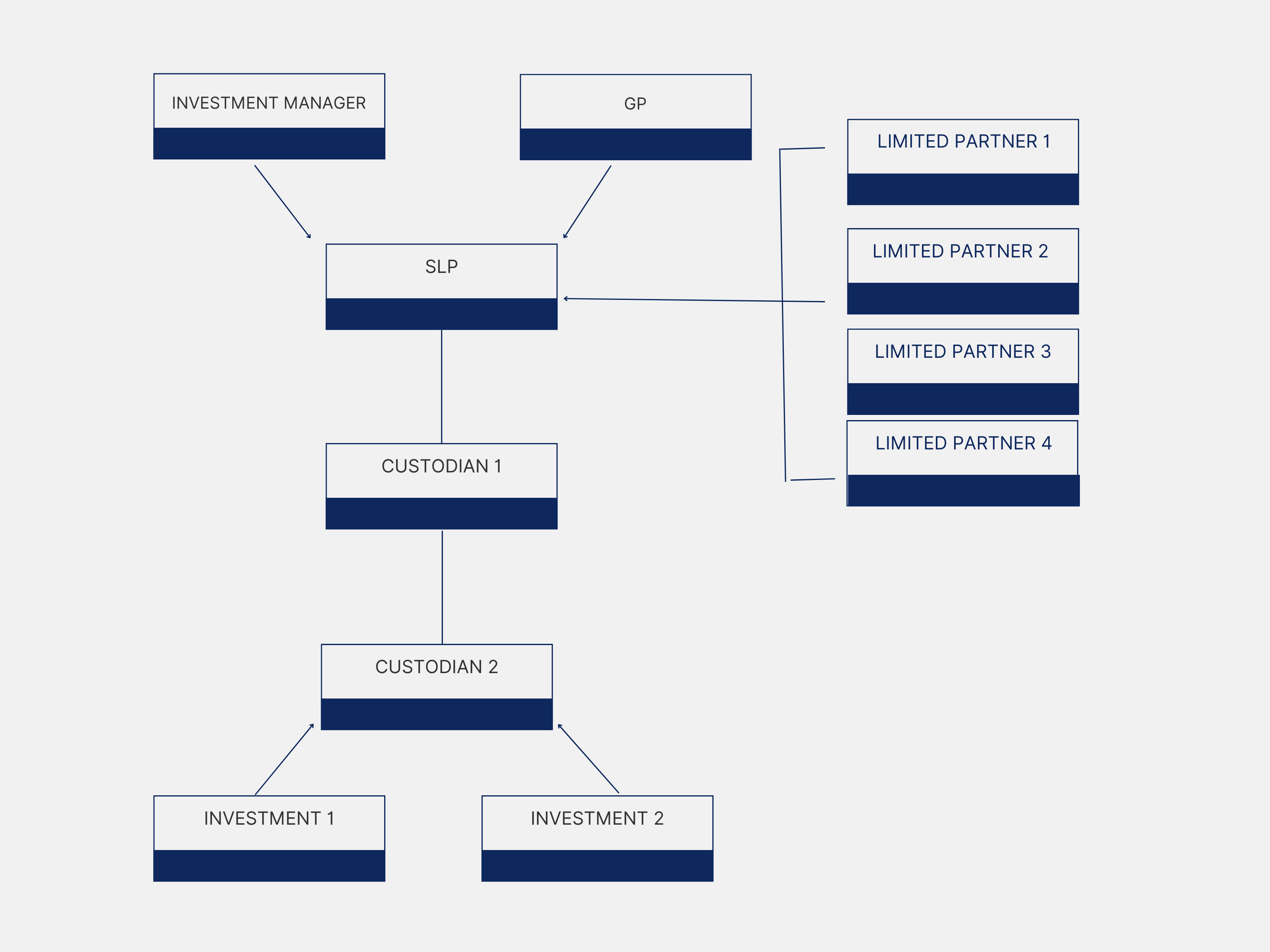

1. Incorporation by General Partner (GP):

The General Partner (GP) is responsible for incorporating the Special Limited Partnership (SLP). The GP has unlimited liability for the obligations of the SLP and typically manages the fund’s operations activities.

2. Appointment of Investment Manager:

An Investment Manager is appointed to manage the pooled funds of the SLP. This professional management entity or individual is tasked with making investment decisions, conducting due diligence, and ensuring the fund’s objectives are met.

3. Ownership by Limited Partners (LPs):

The SLP is owned by Limited Partners (LPs) who invest in the fund through the purchase of Fund Units. These contributions from LPs represent their ownership stakes and entitle them to a share of the profits and losses generated by the fund’s investments.

4. Custodian for Pooled Funds:

The pooled funds contributed by the LPs are held by a licensed custodian, which can be a bank, broker, or other financial institution. The custodian is responsible for the safekeeping of the fund’s assets, ensuring regulatory compliance, and providing administrative support.

5. Investment Distribution According to LPA:

The funds held by the custodian are deployed into various investments as outlined in the Limited Partnership Agreement (LPA). This document governs the fund’s investment strategy, distribution policies, and the rights and obligations of the GP and LPs. It ensures that the pooled funds are invested in accordance with the agreed-upon strategy and objectives.

HF Quarters Fund Management S.A.R.L.

Getting Started with Our General Partner Solution

Partner incorporation solutions support your growth while enhancing your brand identity.Contact us today to customize a solution tailored to your unique needs and unlock the full potential of your fund management strategy.